Fair Labor Standards Act (FLSA)

The status of “exempt” and “non-exempt” under FLSA determines whether an employee is eligible to earn overtime or compensatory time for hours worked in excess of 40 hours per workweek. Employees who are exempt from the requirements of this law do not earn overtime and are paid a monthly salary at Texas A&M University, regardless of the number of hours worked. Employees who are non-exempt from the requirements of FLSA are paid on an hourly basis, on a bi-weekly pay schedule at Texas A&M University and are eligible for overtime pay or compensatory time for hours worked over 40 in a workweek.

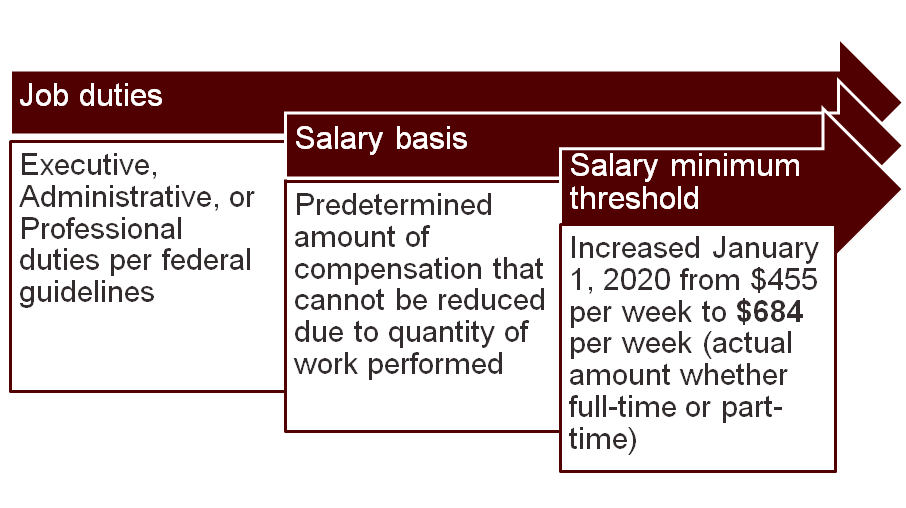

Under the regulations, there are three sets of tests that must be passed to be considered exempt from the FLSA. The first is a job duties test to determine whether a position’s duties primarily involve executive, administrative, or professional duties as defined by the regulations. The second is a salary basis test, which says to be exempt you earn a predetermined amount of compensation that cannot be reduced due to the quantity and quality of work performed. The third is a salary test. Currently, the salary test is a minimum threshold of $35,568 per year ($684 per week or $2,964 per month).

Certain professional positions, such as teachers, doctors, veterinarians, and lawyers, do not have to meet the salary threshold to be considered exempt. This teaching exemption applies to faculty titles and others such as Graduate Assistant - Teaching. Graduate Assistant - Research are also in a special category due to being engaged in research while obtaining an advanced degree under the supervision of a faculty member.

All hours must be entered in Workday through the Workday Time Worklet or in Kronos. Non-exempt employees are paid overtime for hours worked over 40 in the work week (Sunday - Saturday). Non-exempt employees earn FLSA overtime whenever the hours they actually work in a workweek exceed 40 hours.

FLSA overtime is accrued hours actually worked over 40 in a workweek. The FLSA overtime rate is 1 ½ hours of comp time or 1 ½ times the regular rate of pay. Texas A&M University is required to comply with the FLSA rule and must pay overtime regardless of the source of funding. FLSA regulations stipulate that you must pay non-exempt employees overtime pay even if the overtime was not pre-approved. It is important to closely monitor an hourly employee's attendance.

Paid leave—such as vacation and paid sick leave—and holidays do not count when determining FLSA overtime hours. This is not a pro-ratable number of hours; part-time non-exempt employees must work over 40 hours in a workweek before they are paid overtime or accrue overtime compensatory time (federal comp time). Since Texas A&M University is a public institution, we can give federal comp time in lieu of overtime payment. Federal compensatory time has a maximum accrual, which is normally 240 hours except for employees who work in public safety, emergency response, or seasonal activities. These employees can accrue 480 hours. Any overtime worked beyond those limits must be paid until the compensatory time bank can be reduced.

State compensatory time (state comp time) is awarded if an employee hasn’t worked over 40 hours, but the total hours worked and hours of paid leave or holiday pay exceed 40 hours. State comp time is 1 hour of time for every hour over 40 (combined work and paid absence) in a workweek.

Exempt and nonexempt employees who must work on holidays are granted state compensatory time as described in System Regulation 31.04.01, System Holidays.

State compensatory time must be taken during the 12-month period following the end of that workweek and may not be carried forward past the end of the 12-month period. When the member determines that allowing compensatory time off would be disruptive to normal teaching, research, and other critical functions, an employee may be paid for state compensatory time on a straight-time basis.

Your department will determine whether overtime pay or compensatory time off is given for overtime hours. To change comp time from banked to paid or vice versa, the employee’s HR Hub Contact can go to the employee’s worker profile and click on the Actions button, scroll over Personal Data, and click on Edit Other IDs.

The line for Comp Time Banked should be reviewed. If it says:

- No - comp time will be paid out

- Yes - the hours will be banked.

Click the Edit button to change the Other ID preference. Note that if the change is made after a timesheet deadline, the change will not take effect until the next pay period.

If the employee does not have the option of Comp Time Banked in their other IDs, click Edit>Edit Other IDs then click the plus (+) sign to a line to type in Comp Time Banked to add to the list of other IDs. The employee can then specify if they want the comp time banked (yes) or paid (no).

To register for TrainTraq courses, visit TrainTraq in your Single Sign On (SSO) menu.

- TrainTraq Course: 2112755 Comp Time Issues for Employees

- Traintraq Course: 2112756 Comp Time Issues for Supervisors

- System Regulation 31.01.02: Fair Labor Standards

- System Regulation 31.01.09: Overtime

- Fair Labor Standards Act (FLSA) FAQs

- Overtime Calculation in Workday

- U.S. Department of Labor