Explanation of Multiple Employment Overtime in Workday

All hours must be entered in Workday through the Workday Time Worklet or in Kronos. Non-exempt employees are paid overtime for hours worked over 40 in the work week (Sunday–Saturday). When Workday combines hours for overtime, it starts at the end of the work week after determining the total number of overtime hours owed, and then works backwards through the week, analyzing the time submitted on each day to determine which among those many hours is overtime. It prioritizes additional jobs, and if there is any overtime left after that, it puts it on the primary job. The workweek at Texas A&M University is Sunday through Saturday. If the employee submits time outside of Workday through Kronos or another time tracking system, the hours may be calculated differently. Contact your Human Resources office if you use a separate time tracking system outside of Workday.

Texas A&M University is required to comply with the FLSA rule and must pay overtime regardless of the source of funding. FLSA regulations stipulate that you must pay non-exempt employees overtime pay even if the overtime was not pre-approved. It is important to closely watch an hourly employee's attendance. Federal law does not allow an employee to waive their right to appropriate compensation for all hours worked. A non-exempt employee who volunteers to work overtime must be paid for that time because he or she is being "suffered or permitted" (in the language of FLSA regulations) to work for the benefit of the University. To ensure the department has not "suffered or permitted" the overtime work, the supervisor must instruct the employee not to work overtime without prior approval; continued working of unauthorized overtime hours by an employee may become a disciplinary issue. For further details on overtime, please visit the Classification and Compensation Fair Labor Standards Act page and Fair Labor Standards Act (FLSA) FAQ.

Example of Multiple Employment Overtime Calculation Process

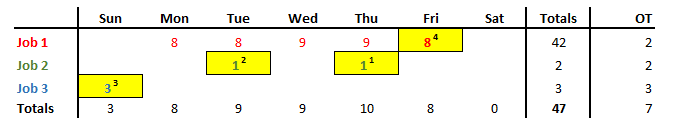

Below is an example of the multiple employment overtime calculation process. Please assume that in this example, the hours from all three positions may be combined when considering overtime.

Of these three jobs, Job 1 is considered the Primary Job in Workday, At the end of the work week, Workday will calculate overtime hours as follows:

- At the end, a total of 47 hours were worked. In accordance with the Fair Labor Standards Act (FLSA), Workday sees that there are 7 federal overtime hours to assign after totaling the combined hours. Workday now looks at the end of the week to find relevant overtime hours.

- Starts on Saturday: 0 hours. No overtime assigned yet.

- Moves to Friday: 8 hours, all hours listed on the primary role (Job 1). Workday will prioritize additional jobs, so no overtime is assigned yet.

- Moves to Thursday: 10 hours. 1 hour worked on Job 2. This is the first hour assigned overtime (superscript 1). One hour out of seven has now been assigned.

- Moves to Wednesday: 9 hours, all on the primary role (Job 1). No overtime assigned.

- Moves to Tuesday: 9 hours. 1 hour worked on Job 2. This is the second hour assigned overtime (superscript 2). Two hours out of seven have now been assigned.

- Moves to Monday: 8 hours, all on the primary role (Job 1). No overtime assigned.

- Moves to Sunday: 3 hours, all on Job 3. These are the next hours assigned to overtime (superscript 3). Five hours out of seven have now been assigned.

- Workday sees there are still 2 remaining overtime hours to assign, so it shifts back to the end of the week and moves backward until Friday, where it assigns two out of the eight hours on the Primary job to overtime (superscript 4).

- All seven overtime hours are now assigned.

Multiple Employment and Overtime

The Classification and Compensation Office reviews dual employment for staff and student worker positions to ascertain whether the hours worked in multiple positions may be combined under the Fair Labor Standards Act for overtime.

- Please note that this overtime calculation process is only initiated if an employee has multiple jobs, two or more of those jobs are labeled as combinable for overtime purposes, and the employee works in excess of 40 hours in a week.

- If an employee works multiple jobs that are not intended to be combined, then overtime calculates normally on any of the held jobs that are considered non-exempt under the Fair Labor Standards Act.

- If an employee works multiple jobs that may be combined, but works less than 40 hours across all held jobs in a week, then there is no overtime owed.

- If an employee works multiple jobs that are combinable for overtime, Workday pays overtime at a blended rate calculated from all the overtime rates together.